U.S.: Why China's Stimulus Is Better than Ours

Source: seekingalpha.com Date: 2009-07-30

The imbalance is intensifying fears about higher interest rates and inflation, and already pressuring the value of the dollar.

On several occasions, senior Chinese officials have warned top members of the US Federal Reserve that it is increasingly disturbed by the Fed's direct purchase of US Treasury bonds.

Federal Reserve Chairman, Ben Bernanke , said it best Tuesday in his statements;

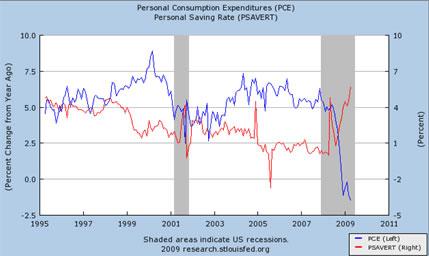

The U.S. consumer burdened with high debt obligations cannot be the driving force for global economic recovery. While housing and household spending appear to be stabilizing, unemployment is likely to remain uncomfortably high over 10% into 2011 and could sap fragile consumer confidence. The liberal capital lending practices we saw in the 90‘s may never return for a generation or more.

Today, we see lots of evidence fearing a backdoor type maneuver based on monetization of US debts .

However, China has wisely begun to diversify away from investing in foreign treasury securities by building on its emerging market plan expected to hit 7.2% GDP growth ( The World Bank news video link ). It has been aggressively pursuing major acquisitions or investments in oil, copper and coal commodity companies among other investments.

For June 2009, Chinese iron ore exports surged 29% in the first half of this year, with steel production running at near record levels in the past quarter of over 50 million tons a month with a record annual figure of over 550 million tons likely. Imports of other raw materials, like copper and aluminum, hit record levels, but now there’s growing suggestions that China has decided to stop stockpiling for the time being.

Power generation rose in June for the first time in 9 months. That��s become a closely watched indicator in the west. Car sales were up 48% in June after rising 47% in May. That��s helping chew up a lot of steel, and iron ore and coal from countries like Australia.

Sales of locally made cars jumped 36.6% as well in June: total sales were 1.1 million units, or more than in the US. Figures out Tuesday hit a record $US2.13 trillion at the end of June, the highest ever. It was up a strong $US175 billion or more (Just $US7.7 billion in the first quarter).

Additionally, the Chinese Ministry of Water Resources has made major progress in hydro-electric and wind power deals. China has built a total of 43,000 small hydro-electric projects for 300 million people living in the mountainous areas. The 43,000 small hydro-electric power stations nationwide produce 23 million kwh a year.

The small hydro-electric power stations now under construction have a combined generating capacity of five million kw in the past six years, such stations with a total generating capacity of over one million kw went into operation each year and the government's annual input in such power projects tops 13 billion yuan (about 1.5 billion US dollars).

China plans to increase the per-capita consumption in rural China to 400 to 600 kwh by the year 2010 as against the current 280 kwh by adding more such small stations.

Further, China-based wind turbine manufacturers have overtaken foreign competitors in the race to supply domestic wind power projects for the first time. Presently, China produces just over 6 gigawatts (GW) of wind energy, making it 5th in the world for total wind energy. Today, Germany leads total wind energy with 22.2 GW.

However, with China‘s massive push for 21st century renewable technologies, we shouldn’t be surprised if China achieves 100 GW by 2020.

According to figures from the state-run Chinese Wind Energy Association, domestic and Sino-foreign joint venture turbine makers accounted for 61.8% of China‘s market share at the end of 2008, surpassing overseas producers for the first time.

The top three wind turbine suppliers in China are homegrown companies Sinovel Wind, Goldwind Science & Technology, Dongfang Electric Corporation followed by Denmark's Vestas Wind Systems (VWDRY.PK), the world's largest turbine manufacturer and Spain-based Gamesa giving domestic companies an edge.

Recently, Timken Co. of Canton, Ohio (TKR) signed a multiyear agreement to supply wind turbine gearbox bearings for a Chinese manufacturer of wind power, marine, construction and industrial gear transmission equipment. Under terms of the $30 million agreement with Nanjing High Speed Gear Manufacturing Co.; Timken will supply tapered and cylindrical roller bearings for use in the Chinese company’s wind power gearboxes.

Continuing its natural resource - energy spending spree China's Sinopec announced it will acquire oil explorer Addax Petroleum for $7.2 billion, in what would be the largest overseas takeover ever by a Chinese company. Sinopec, a refiner, would gain access to substantial reserves in West Africa and the Middle East if the takeover of Addax is approved.

Just announced, mining company Teck Resources Ltd. is selling a 17% stake to China Investment Corp. for 1.74 billion Canadian dollars - $1.5 billion in a bid to reduce its debt. The Vancouver-based company CIC is now the world's largest commodity buyer, and will buy 101.3 million class B voting shares for 17.21 Canadian dollars each. CIC will hold onto the stock for at least a year, said the mining company.

With the backing of Beijing, cash-rich Chinese investors have spent the past several weeks working on a spate of overseas resource deals. Buoyed by a relatively strong yuan exchange rate, Chinese buyers have taken advantage of depressed commodity prices to pursue overseas assets with vigor.

The deals announced so far include a US$19.5-billion bid by state-owned metals company Aluminum Corp of China (ACH) for a 18% stake in Australia‘s Rio Tinto Group (RTP), a U$25-billion loan to Russian oil company Rosneft, and a US$10-billion loan to Petrobras of Brazil. Chinese investors have also agreed to plough billions more into Australian and Mongolian iron ore mining companies, gas and pipeline deals in Turkmenistan, and Kazhakstan’s copper and lead mining industry.

Late last month, China National Petroleum Corp launched a friendly $443-million offer for Calgary-based Verenex Energy Inc. to give the state-owned oil company a stake in a promising Libyan oil concession.

China continues to seek low valuations elsewhere to particularly resource-rich Africa, Canada, Venezuela, and Brazil.

Most recently, China strengthened its relations in Russia making joint efforts to oppose trade protectionism. It has promised to support Russia's bid for membership of the World Trade Organization (WTO). China mainly exports machinery, light industrial products and textile to Russia, while Russia's exports natural resources to China primarily include crude oil, natural gas and lumber.

We even find consumer technology investments accelerating as China Crescent Enterprises, Inc. (CCTR.OB) announced increasing its previous expectations for profitable revenue growth in 2009. The Company reported over $40 million in profitable revenue as a reseller and integrator in China for Hewlett-Packard (HP), Sony (SNE), Lenovo (LNVGY.PK) and other brand name technology companies.

The recent spate of resource deals is a way for China to diversify rather quietly some of its foreign exchange reserves. In almost every sector we see, positive signs in China as it appears to be leading the move towards recovery.

Automotive

China is now one of the largest automotive markets in the world, trailing only the United States and Europe. In 2009, it’s estimated that ten million new motor vehicles in China will be sold. There are approximately 100 vehicle OEMs, with 40 producing passenger vehicles. Major domestic firms include the China First Automobile Group Corp. (FAW), Dongfeng Motor Corp. (DMC) and Shanghai Automotive Industry (Group) Corp. (SAIC).

Alternative Fuel Vehicles

China encourages the development of clean and fuel efficient vehicles in an effort to sustain continued growth of the country‘s automobile industry. By the end of 2009, China plans to reduce the average fuel consumption per 100 km for all types of vehicles by 15%. The proportion of vehicles burning alternative fuel will be increased to help optimize the country’s energy consumption. Priority will be given to facilitating the research and development of electric and hybrid vehicles as well as alternative fuel vehicles, especially CNG/LNG. Major cities like Beijing and Shanghai already require Euro III emission standards.

Auto Parts

China has about 6000 automotive enterprises, which are scattered in five sectors: motor vehicle manufacturing, vehicle refitting, motorcycle production, auto engine production, and auto parts manufacturing. Nearly 80% of the revenue for the auto parts and accessories market is through new vehicle sales. However, revenue from after market is increasing rapidly.

Shanghai and its surrounding provinces (Zhejiang, Jiangsu, and Anhui) are the centers for component manufacturing, representing around 44% of national production. Shanghai is home to Shanghai General Motors, Delphi, Visteon, and other notable American automotive companies and, as such, provides a good starting point for U.S. automotive component exporters to begin to explore the Chinese market.

Used Motor Vehicles and Used/Refurbished Auto Parts

Although, there are case-by-case exceptions for antiques and diplomats, it is currently illegal to import used motor vehicles into China. Refurbished heavy construction equipment can be imported with a special permit. Used and refurbished auto parts are not allowed to be imported into China.

Automotive After-Sales Products and Services

Although improvements have been made in this field in the past decade, China's after-sales products and services still lag far behind those of developed countries. China‘s aftercare market now faces the following challenges:

- Establishing an information feedback system with end-users in order to improve service;

- Modernizing outdated sales systems;

- Increasing the competitiveness of domestic auto parts and accessories;

- Cracking down on counterfeit products.

Transportation Infrastructure

The Chinese government is in the midst of a massive upgrade of its transportation infrastructure. Until recently, China’s economy was able to continue to grow despite deficiencies in infrastructure development. This is no longer the case, and the Chinese Government realizes that in order to keep their economy moving forward, they need an efficient system in place to move goods and people across this 9.326 billion sq. km. land mass.

According to World Bank statistics, goods lost due to poor or obsolete transportation infrastructure amounted to one percent of China's GDP as recently as the most current survey (mid 1990's). Logistic costs account for 20% of a products price in China, compared to 10% in the U.S.

Ports are being improved for greater use of China‘s waterways, and airports are being improved across the country. All of these projects bring opportunities to U.S. construction equipment, engineering, and electronics and safety devices companies, especially for projects funded by the World Bank, Asian Development Bank, OECF, and similar multilateral lending agencies that use transparent bidding procedures.

Highways

Recently, China has rapidly accelerated developing its highway system. The investment for highway construction has increased enormously. Improving infrastructure has facilitated the increased use of automobiles. The government has added about 3,000 km of expressway a year to the existing network. China has already built a 30,000 km network of highways, second only to the U.S. in total kilometers.

Ports

China has sixteen major shipping ports including the highly touted Port of Shanghai enhances capacity to over 50 million tons per year. China’s total shipping capacity is in excess of 2,890 million tons. By 2010, 35% of the world‘s shipping is expected to originate from China. .

Rails

Passenger rail traffic has priority over freight on the many single-track rail lines across China, extending trips which should last a few days to two weeks or more, and limiting investment interests in all but a few coastal regions. Rail tracks are now being doubled to alleviate freight train conflicts. China Architectural Engineering Inc (CAEI), a small construction company has received projects to help build the world's longest automated high speed rail system in Zheijiang. Read China Inks Deal with Siemens for World's Largest High Speed Rail Network

The Keys to Chinese Growth

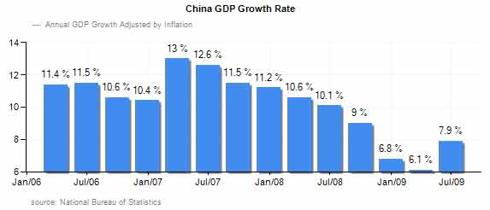

In the Q2, 2009; China's real GDP growth accelerated to 7.9%, after reaching 6.1% in the first three months of this year.

Indeed, there is some evidence the 4 trillion Yuan (US$585 billion) stimulus package is producing results. For example China's industrial production increased 10.7% in June from a year earlier after an 8.9% gain in May and property investment growth accelerated to 17.9% in June from 11.9% in May. Looking further, retail sales which rose 15% in the first half year and household survey data both point to stronger household consumption.

To make things even better, banks, prompted by government orders, are extending loans and M2 money supply is growing at a record pace. Also, China plans to boost welfare spending by 29%, giving 20 billion yuan in subsidies this year to help rural residents buy televisions, fridges and other electrical appliances.

Unlike the US, China has a $2 trillion surplus to invest with relatively few obstacles towards long-term growth but simply submitting the highest M&A bid for a company will not always be sufficient to seal a deal, particularly if investors believe that government ownership is permitting a bidder to offer a premium price in order to secure captive supply sources.

To overcome such resistance, partially owned state enterprises will need to better publicly define their operating independence from the government and more clearly promote the economic benefits of proposed mergers to shareholders of target companies.

China could make clear that any continued investments in US government debt merit administration support for direct Chinese investments in the United States, also a hedge against any future protective tariff barriers designed to compensate for a shrinking tax payer base with hopes of increasing tax revenues to pay off the massive US debt. For example, the Japanese already have significant manufacturing facilities within the US thus positioned well to avoid a tariff barrier scenario.

Despite tremendous positive signs, we saw Chinese exports fall for the eighth straight month in June reminding us the global recession is still cutting global demand. In fact, overseas sales slid 21.4 % in June from a year earlier, after a record 26.4% drop in May. Moreover, a recovery in export demand could be slowed by rising unemployment in the European Union and the U.S., China’s top two overseas markets. There is a danger that the Chinese economy may slow again as the effects of the stimulus wanes. It remains to be seen as the Chinese continue to diversify.

In the long run, economic value generally trumps politics in M&A, especially when transactions are handled optimally. If the Chinese move towards adopting such evenhanded treatment policies it could open up even more significant revenue opportunities as the decade of China‘s middle class growth explosion accelerates.